This blog post originally appeared in Huffington Post.

This blog post originally appeared in Huffington Post.

We are beginning to see signs that Congress may be willing to move beyond the partisan divide over the Affordable Care Act (ACA), which hopefully means that we can fix problems with current law, build upon what is working, and continue to make progress in improving our nation’s health care system. It is about time.

Nearly six years ago, the ACA was passed and it has made significant headway in cutting the uninsured rate in the country through an expansion of Medicaid for millions of low-income adults, the elimination of pre-existing conditions exclusions and annual or lifetime limits imposed by private health plans, and through the creation of tax credit subsidies to assist millions of other uninsured Americans purchase private health insurance. According to Dan Diamond’s analysis in Forbes of recent data from the Centers for Disease Control and Prevention (CDC), “Nearly 16 million fewer Americans were uninsured in early 2015 compared to 2013.”

However, beyond that and the extension of the bipartisan and wildly popular Children’s Health Insurance Program (CHIP) last March, health policy has been largely stuck in partisan gridlock. Rather than work to fix problems that have arisen with the ACA, many of the opponents of “Obamacare” have insisted “every single word” of the bill be repealed, but that would have the effect of cutting off millions of people from health coverage and disrupting health coverage for millions of others. At the same time, proponents of the law have often displayed knee-jerk opposition to “opening up the legislation” to any changes, even to problems with the law. Gridlock has largely been the result.

Breaking the impasse, Sens. Dean Heller (R-NV) and Martin Heinrich (D-NM) and Rep. Joe Courtney (D-CT) came together on a bipartisan basis to introduce legislation to repeal the High-Cost Plan Excise Tax (otherwise referred to as the “Cadillac tax”) in the ACA. The “Cadillac tax” would have imposed a non-deductible excise tax of 40 percent on the value of employer-sponsored health coverage that exceeds certain benefit thresholds: $10,200 for self-only coverage and $27,500 for family coverage in 2018. Although Congress and President Obama did not agree to a full repeal of the tax, they reached an agreement to delay the tax for two years.

In support of the legislation, Sens. Heller and Heinrich argued:

The Cadillac tax will hurt middle-class families who, for reasons outside of their control, have health plans that already or soon will reach the Cadillac tax’s cost limits. The tax will force many employers to pay steep taxes on their employees’ health plans and flexible spending accounts, and possibly eliminate some employer-provided health coverage plans altogether. Under this tax, deductibles will be even higher and benefits will be reduced even more –putting a strain on middle-class families trying to make ends meet.

Although the term “Cadillac tax” implies it would only impact high-cost, “gold-plated” health plans, in a 2014 Towers Watson survey of employers, 82 percent thought the tax could impact their health plan by 2023. And to avoid the excise tax, an Aon Hewitt survey found one-third of employers were looking to pass-on “higher out-of-pocket costs” in their employee and family health plans.

Consequently, both employers and employees were becoming increasingly concerned about the Cadillac tax. According to Heller and Heinrich:

Organized labor, chambers of commerce, local and state governments, small businesses, and rural electric co-ops have come together to express the same concern: the Cadillac tax needs to be fully repealed or our employees will experience massive changes to their health care.

Another important group that is infrequently mentioned, but who would be disproportionately harmed, are children and those with family coverage. In a 2009 First Focus/Economic Policy Institute analysis by Elise Gould on the impact of excise taxes that were included in various health proposals prior to the passage of the ACA (including those in presidential candidate John McCain’s 2008 health plan and President Bush’s 2009 budget proposal), tax caps on employer-based family plans were often set for family plans at just two times that of individual coverage. However, since the cost for family coverage has historically been much higher than that, these caps would have more heavily and disproportionately short-changed family coverage.

Recognizing this, the ACA’s congressional authors revised the initial legislative limits and set a higher, and yet, still arbitrary cap on family coverage. As a result, the law’s Cadillac tax was established at an amount that was 2.7 times the cost for family plans than for single coverage ($27,500 for family plans to $10,200 for individuals) – a wider spread than at the levels set in previous ACA drafts. However, according to a 2015 Kaiser Family Foundation/Health Research & Education Trust (HRET) Survey of Employer-Sponsored Health Benefits, the average premium for family coverage is actually 2.81 times that of single coverage, so the ACA’s Cadillac tax would still hit family plans disproportionately.

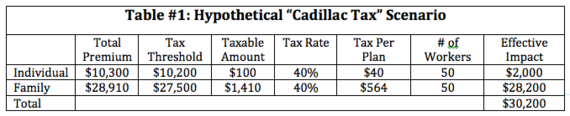

As an example, Table 1 outlines the impact that the Cadillac tax would have had on a hypothetical company with 100 workers and premiums of $10,300 for individual coverage (50 employees) and $28,910 for family coverage (50 employees) in 2018. Reflecting the average 2.81 family-to-individual cost per plan ratio, both the individual and family coverage would exceed the threshold slightly, but enough to trigger the tax.

As this scenario demonstrates, kids and families would largely bear the brunt of the excise tax. In fact, the taxable amount would be more than 14 times greater for family plans than for individuals. Moreover, in this example, 94 percent of the Cadillac tax would fall upon family plans and, therefore, the children and families enrolled in them.

Although some employers might pay the tax, the more likely scenario is that employers would increase deductibles, limit benefits, or impose higher cost sharing upon families to lower the cost of the insurance coverage below the cap. However, this merely shifts the cost of coverage to families and will make it unaffordable for some, particularly since families already absorb a much higher share of the premium costs in employer-sponsored coverage than individual workers.

According to the Kaiser/HRET 2015 survey, “Covered workers contribute on average 18 percent of the premium for single coverage and 29 percent of the premium for family coverage.” Consequently, the average annual worker’s contribution toward the premium is $1,071 ($89 per month) for individual coverage and $4,955 ($413 per month), or 463 percent more for family plans.

Since those numbers reflect the average, the disparity is, by definition, even worse than that for half of families. The Kaiser/HRET survey, for example, found that 45 percent of all firms surveyed “contribute the same dollar amount for family coverage as for single coverage.” In such firms, 100 percent of the added costs of family coverage are absorbed entirely by the employee.

The share of premiums absorbed by workers is also greater for family plans in small firms or in firms with a higher percentage of lower-wage workers (defined as having at least 35 percent of workers earn $23,000 a year or less): 36 percent and 41 percent, respectively. For many families, these higher premiums along with limited benefits and higher out-of-pocket costs, including rapidly rising deductibles, have had the effect of making health coverage increasingly unaffordable to many families. This is a major reason why 59 percent of adults but just 47 percent of children have health coverage through employer-sponsored health insurance.

Consequently, delaying or eliminating the Cadillac tax is important in protecting when tenuous health coverage some families currently have for their children. This is why First Focus Campaign for Children joined groups like the American Cancer Society Cancer Action Network and the National Association of Counties as members of the Alliance to Fight the 40 in support of the Heller/Heinrich and Courtney bills.

Although support for continuation of the Cadillac tax largely came from some of the law’s supporters, the fact is that delay or outright repeal of the Cadillac tax is actually quite consistent with one of the prime objectives of the ACA, which the Department of Health and Human Services explains is to “[m]ake coverage more secure for those who have insurance, and extend affordable coverage to the uninsured.” If the Cadillac tax had been allowed to take effect, it would have weakened health coverage for a number of individuals and families.

Furthermore, delay or repeal of the excise tax helps fulfill the Administration’s oft-mentioned promise that the law protects and even strengthens current private coverage. As the President said at a Town Hall meeting in Grand Junction, Colorado, on Aug. 15, 2009:

I just want to be completely clear about this. I keep on saying this but somehow folks aren’t listening — if you like your health care plan, you keep your health care plan. Nobody is going to force you to leave your health care plan.

Since the Cadillac tax would undermine private coverage by making it more unaffordable for a rapidly increasing number of families over time, many supporters of Obamacare, including Rep. Joe Courtney, a majority of the 184 cosponsors of Courtney’s bill, and Democratic presidential candidates Hillary Clinton and Bernie Sanders, support its repeal.

Many ACA supporters also recognize that, as employers moved to raise deductibles, reduce benefits, or increase other out-of-pocket costs to meet the caps established by the Cadillac tax, they could and some have already, as Michael Hiltzik of the Los Angeles Times explains, “scapegoated Obamacare” for the cost-shifting to employees.

This is, in part, why some opponents of Obamacare actually opposed the delay of the Cadillac tax. In a recent Op-Ed, Mike Needham of Heritage Action for America correctly pointed out that the excise tax “forces employers to cut back the coverage that they offer” and that its repeal would help “stabilize Obamacare.” However, since he opposes the ACA, Needham argued against delaying or repealing the Cadillac tax because leaving in place such “adverse effects” would help undermine the law.

Since the Cadillac tax was delayed for two years, this debate will need to be revisited prior to 2020. Fortunately, with bipartisan extension of CHIP last spring and the Cadillac tax’s delay, Congress seems to be beginning to show important signs of moving past the partisan divide to a better place where we can once again work, on a bipartisan basis, toward improving our nation’s health care system.

For children, the CDC estimated in early 2015 that less than 5 percent of our nation’s children were uninsured – down from 14 percent in 1997 when CHIP was first enacted into law. In fact, since CHIP’s passage, the uninsured rate for kids has been cut by nearly two-thirds.

To continue that progress, we should simultaneously reject proposals, such as Medicaid block grants or the Cadillac tax, that would destabilize the progress that has been made in recent years, while continuing the march toward the “Finish Line” goal of ensuring every child in America has comprehensive, child-centered, quality health coverage.

‘Cadillac Tax’: http://bit.ly/1OMKl3h by @BruceLesley v/ @Campaign4Kids #InvestInKids

![]() Tweet this now.

Tweet this now.

Do you share our vision of making America a better place to be a child and raise a family? Then you should be a part of The Children’s Network, a movement led by individuals, non-profit organizations, and businesses committed to the health, education, and well-being of children in the United States.Become a part of the network and receive exclusive materials, updates, and opportunities to take action on behalf of our children.

First Focus Campaign for Children is a bipartisan organization advocating to making children and families the priority in federal policy and budget decisions. You can support our work by making a donation or joining The Children’s Network to receive updates and action alerts.