Children in the wealthiest nation in the world should not be living in poverty. And yet, 1 in 6 children in the United States do. The negative consequences that even short stints in poverty have on the health, education, and well-being of children is enormous. The National Academy of Sciences, Engineering, and Medicine (NASEM) issued a report in 2019 that highlighted an estimated cost of child poverty to the nation of between $800 billion and $1.1 trillion annually.

In contrast, during the 1960s, the U.S. embarked on a “War on Poverty” that successfully cut poverty among senior citizens in this country. Substantial investments were made to improve the well-being of senior citizens over a half-century ago and they have worked. As Ron Haskins of the Brookings Institution writes:

In 1966, a year after [President Lyndon] Johnson expanded Social Security and enacted Medicare and Medicaid, elderly poverty was 28.5 percent. By 2012, it had fallen to 9.1 percent, a decline of about 68 percent.

Some important steps to alleviate poverty in children were also taken in the 1960s due to the creation of food stamps, child nutrition programs, and Medicaid, but the dichotomy between, for example, the successful expansion of Social Security for senior citizens and the policies of Aid to Families with Dependent Children (AFDC) and the subsequent Temporary Assistance for Needy Families (TANF) programs for kids has been vast. According to the Urban Institute, federal spending on the elderly is six times more than that on children.

Unless something changes, the gap will continue to widen.

Social Security successfully cuts poverty.

Melissa Kearney at the Brookings Institution points out that “we would essentially eliminate child poverty in this country” if we “gave every child living in poverty the average Social Security benefit received by a Social Security recipient age 65 or over.” Unfortunately, for the most part, low-income children must rely on TANF, and it does far less to reduce poverty than it did even 25 years ago.

For more than half a century, we have failed to address child poverty in this country. This neglect has resulted in negative outcomes on child well-being and threatens our nation’s future. A child who grows up in poverty is far less likely to perform as well as their classmates in school, more likely to have food insecurity, more vulnerable to homelessness, and more likely to be subjected to violence, abuse, and neglect. While the United States proudly leads the world in science, technology, innovation, and sports, we sadly also leader in infant mortality, violence against children, and child poverty. Despite lots of expressed concern for children, our nation’s leaders have failed make needed investments in child well-being.

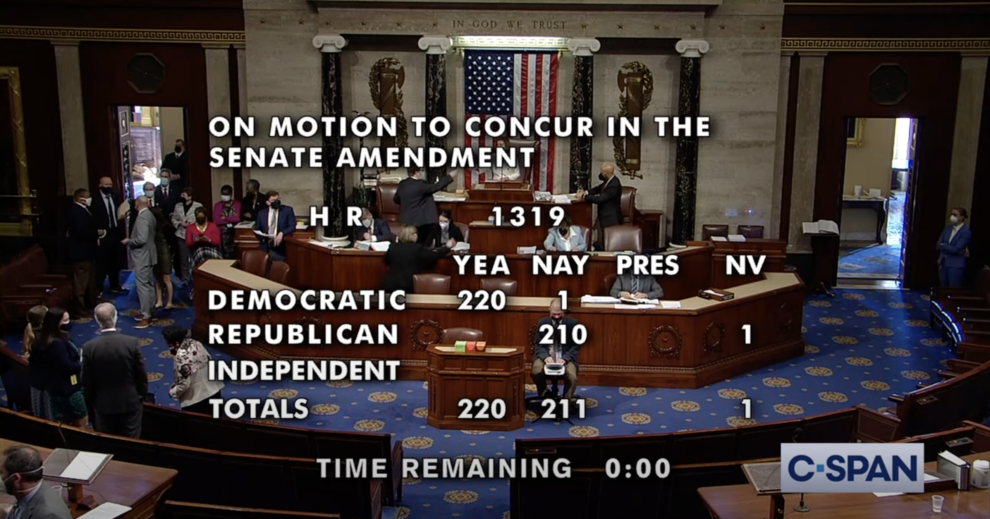

Fortunately, more than a half-century after we undertook a commitment to our nation’s senior citizens to cut poverty, now is finally that moment for children. The American Rescue Plan Act, which Congress has now passed and President Biden has signed into law, has many important provisions for our nation’s children.

However, the bill’s expansion of the Child Tax Credit (CTC) in the bill will have the most significant impact on child poverty.

The Journey Has Been a Long One, and It Is Far From Over

The legislation marks a historic improvement for millions of children in the country, and it has been a long time coming.

Specifically, the CTC provisions in the American Recovery Plan Act that were drafted by House Ways and Means Committee Chairman Richard Neal (D-MA) and Senate Finance Committee Chairman Ron Wyden (D-OR) are borrowed, in large part, from the American Family Act, which had been introduced in different forms at least 10 times by Rep. Rosa DeLauro (D-CT).

The American Family Act, sponsored by Sens. Michael Bennet (D-CO), Sherrod Brown (D-OH), and Cory Booker (D-NJ) and Reps. DeLauro, Suzan DelBene (D-WA), and Ritchie Torres (D-NY) increases the Child Tax Credit to $3,600 a year for kids less than age 6, $3,000 for older children and youth, and makes the credit fully refundable.

These improvements to the CTC are particularly important to low-income children, as the current CTC gives only partial or no benefit to one-third of children because their parents make too little to qualify for the full credit. Instead, the CTC will now be fully refundable.

Consequently, the Center on Poverty and Social Policy (CPSP) at Columbia University estimates these changes would cut child poverty by an astounding 45 percent.

In combination with other provisions in the American Rescue Plan Act, CPSP estimates that child poverty would be cut by more than half.

Therefore, this is why many of us in the child advocacy field argue that this is the most significant public policy change for children since the enactment of the Children’s Health Insurance Program (CHIP) in 1997. As the New York Times’s Jason DeParle reports:

More than 93 percent of children — 69 million — would receive benefits under the plan, at a one-year cost of more than $100 billion.

Advocacy Matters

Many advocates for children and families, such as members of the Child Poverty Action Group (CPAG-USA), have supported the American Family Act over many years and other efforts to reduce child poverty, including funding for child care, SNAP, and housing.

CPAG led a campaign (End Child Poverty U.S.) to support policy change, such as the Child Poverty Reduction Act by Sen. Bob Casey (D-PA) and Rep. Danny Davis (D-IL), that would create a goal or target to cut child poverty in half in the short-term and to eradicate it in the long-term.

This effort was patterned off of successful efforts by British Prime Minister Tony Blair in 1999 that created the goal, the framework, and accountability for dramatically reducing child poverty in the UK. As Columbia University’s Jane Waldfogel explains, the UK child poverty rate was much higher than in the U.S. rate in 1999 but dropped dramatically and has remained below the U.S. rate for the last two decades. We remain strongly supportive of this legislation, as it creates a national goal and provides accountability for achieving it in the U.S.

Furthermore, First Focus on Children is pleased to have worked closely with Reps. Lucille Roybal Allard (D-CA) and Barbara Lee (D-CA) on an appropriations amendment in 2015 that successfully secured funding for the landmark National Academy of Sciences, Engineering, and Medicine (NASEM) report entitled A Roadmap to Reducing Child Poverty that was released in 2019.

As Rep. Roybal Allard explained:

The findings of this report, “A Roadmap to Reducing Child Poverty,” give new depth to our understanding of the causes and the devastating consequences of child poverty, and their recommendations lay out a roadmap for our government to follow as we work to cut child poverty in half in the coming decade. I commend this report to all those who care about the welfare of America’s children; I am certain it will give new depths to our nation’s perspective on child poverty for many years to come.

In 2017, CPAG issued a compilation of recommendations entitled Family Tax Policy: A Path Forward to Lifting Children Out of Poverty to improve tax policy for our nation’s children and families. The study called for making the CTC: (1) fully refundable; (2) increasing the value of the credit; (3) creating a “Young Child Tax Credit” to make the credit greater for those under 6 years of age; (4) indexing the credit for inflation; (5) protecting the eligibility of the children of immigrants; and (6) establish a universal child allowance.

The report also made recommendations for improvements to the Child and Dependent Care Tax Credit (CDCTC), such as making the credit fully refundable, and the Earned Income Tax Credit (EITC), including expanding it to include coverage of former foster youth and other young adults under the age of 25 who are not in college.

We are pleased that the American Rescue Plan Act has adopted these critically important improvements to the CTC, CDCTC, and EITC, but they are temporary and so the work to make them permanent begins today.

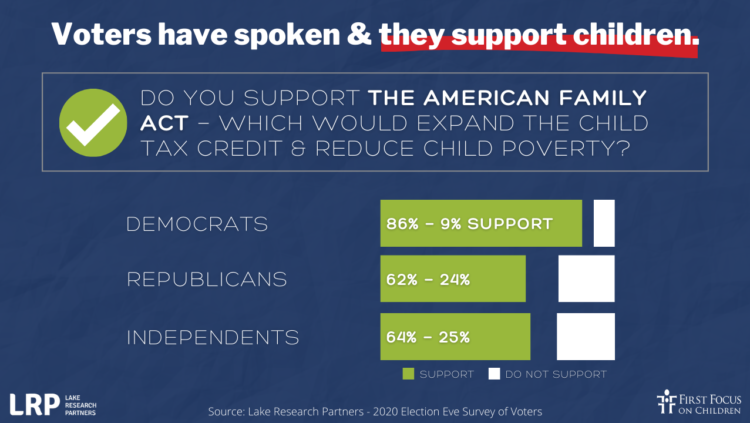

The American public are strongly supportive of these improvements to the tax code and their impact on poverty. As an example, in a 2020 election eve poll by Lake Research, voters supported adoption of the American Family Act and its improvements to the CTC by an overwhelming 71–18 percent margin, including 86–9 percent among Democrats and 62–24 percent among Republicans.

The Journey Ahead

In Congress, there is some bipartisan support for making these changes permanent. For example, Sen. Mitt Romney (R-UT) has offered a similar plan to the American Family Act entitled the Family Security Act.

Sen. Romney’s plan is actually slightly more generous in one respect: the child credit or allowance would be $4,200 per year for children under the age of 6. However, the proposal also eliminates TANF, the CDCTC, the tax deduction for head of household, and categorical eligibility that simplifies enrollment in SNAP.

In the case of both President Biden and Sen. Romney, their support for this type of historic improvement to the Child Tax Credit represents significant progress for children in comparison to positions they have taken in the past.

In Romney’s case, during his 2012 presidential run, he criticized both the EITC and CTC because the credits resulted in “47 percent of people pay no income tax” and he proposed allowing the expansions to both programs enacted under President George Bush to expire.

Although a number of conservatives are opposed to making the CTC fully refundable and becoming an allowance, Romney’s position today more closely mirrors the positions of Presidents Bush and Ronald Reagan than it did in 2012.

As conservative columnist George Will advised fellow conservatives after the 2012 election:

. . .quit despising the American people, particularly because a lot of what they’re despising them for are Republican policies. When Mitt Romney said, ‘So many Americans aren’t paying taxes,’ yeah, because the Republicans doubled the child tax credit for conservative reasons, yes, because they expanded the Earned Income Tax Credit, as Ronald Reagan did, because they thought it was an effective anti-poverty program.

In announcing his Family Security Act earlier this year, Romney said:

We have not comprehensively reformed our family support system in nearly three decades, and our changing economy has left millions of families behind. Now is the time to renew our commitment to families to help them meet the challenges they face as they take on (the) most important work any of us will ever do — raising our society’s children.

In Biden’s case, he voted for the 1996 “welfare reform” package that eliminated AFDC and created the TANF block grant with work requirements. TANF doesn’t even have “cutting child poverty” as an objective of the program, and today, kids have a poverty rate that is more than 50 percent greater than adults.

But Democrats also shifted. Recognizing the Republican abandonment of their past support of “family values” and support of tax credits to support them, the 2012 Democratic Party platform supported by President Barack Obama and Vice President Biden read:

It’s time we stop just talking about family values and start pursuing policies that truly value families. The President and Democrats have cut taxes for every working American family, and expanded the Child Tax Credit and Earned Income Tax Credit.

Consequently, this week, President Biden will be signing into law the most significant effort to tackle child poverty ever.

These shifts in the political support for tackling child poverty are occurring for a number of reasons.

First, as noted before, supporting improvements in child policy is increasingly recognized as good politics. Policymakers are recognizing that Americans strongly support children’s public policy improvements and investments. For example, by an overwhelming 71–18 percent margin, a 2020 Lake Research Partners poll found that voters overwhelmingly supported passage of the American Family Act. And back in 2012, counter to the position of candidate Romney, a 2012 Lake Research Partners poll found that voters supported extending the EITC and CTC credits that were scheduled to expire by an 81–12 percent margin.

Second, there is growing understanding and recognition that poverty is a public policy choice. For years, many people believed that child poverty was intractable and the sole responsibility of parents, but there is a growing understanding that policy and money matter. Other countries, including the UK, Canada, and New Zealand, have demonstrated that policy changes can make an enormous difference in the outcomes of the lives of children.

As noted before, the U.S. successfully cut poverty in senior citizens over the last half-century. It is well past time to do the same for our nation’s children.

Third, there is a growing recognition that there is a multi-generational need for our children to be successful. The demographic challenge facing our nation requires the next generation of workers to build an even stronger economy to fund and support Social Security and Medicare for the huge cohort of aging Baby Boomers. As Dowell Myers at the USC Price School of Public Policy explains in a report entitled The New Importance of Children in America:

Ensuring the health and well-being of children in the U.S. has never been more critical to the nation’s economic and political future. The massive Baby Boom generation is aging and retiring at the same time that birth rates are declining and altering the social and economic landscape. . .

This relative shortage of children means each child — regardless of gender, ethnicity, geographic residence or economic background — is proportionately more important to our future than ever before. Beyond our moral obligation to care for children for their own sake, our future economy, our standard of living, and our place as a leader in the world demand that children become our highest priority.

Demographer William Frey at the Brookings Institution adds:

Perhaps just in the nick of time, we have a new administration that understands the urgency of policies that benefit children, including the direct cash benefits proposed in the American Rescue Plan or other initiatives to support child nutrition, public education, and family caregiving. These efforts — as well as a renewed call to reduce racial and ethnic inequalities — suggest that the Biden administration understands the importance of investment in children. These policies could help ensure that today’s children and tomorrow’s working-age citizens have the opportunity to advance a growing middle class, raise healthy families, and contribute to older generations’ and the nation’s future well-being.

Fourth, there is overwhelming evidence that making investments in children has a high rate of return. As noted before, the NASEM found:

Child poverty costs for the U.S. range between $800 billion and $1.1 trillion annually, based on the estimated value of reduced adult productivity, increased costs of crime, and health expenditures associated with children growing up in poor families.

Furthermore, in a study entitled The Costs and Benefits of a Child Allowance by CPSP, Irwin Garfinkel and his colleagues found the value to society of an expansion of the Child Tax Credit and its sizable reduction in child poverty reaps “current and future benefits for society” that are “more than eight times initial costs.”

As the CPSP concludes:

We find that child allowances are a winning investment in our children’s future mobility.

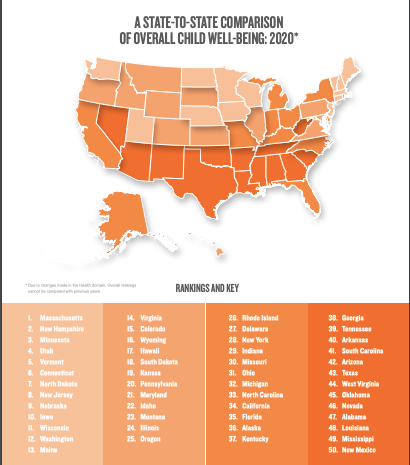

Fifth, we need a new social contract for our nation’s children. On a whole range of international child well-being indicators, U.S. children are not faring well.

Our nation has one of the highest rates of child poverty among Organisation for Economic Co‑operation and Development (OECD) countries, the percentage of uninsured children has been rising for the last four years after two decades of progress, the U.S. ranks 33rd out of 36 OECD countries on infant mortality, suicide rates among children are rising dramatically, the number of homeless children is growing, and child hunger has been increasing. It is important to note this was happening to our kids even before the global pandemic and economic recession.

Unfortunately, as First Focus on Children’s Children’s Budget 2020 finds, the overall share of federal investments in children dropped from 8.19 percent in fiscal year (FY) 2016 to just 7.48 percent in FY 2020 — a drop of 9 percent — with the Trump Administration proposing even further cuts.

Trump proposed cuts to children’s programs despite the fact that the U.S. ranks at the bottom of the world’s wealthy nations in support to children and families.

With all the challenges facing children, Frey points out:

It did not help that the Trump Administration avoided investments in child-centered programs, be they education, health care, or other family supports. Nor did it make efforts to reduce racial inequalities on any of those fronts.

President Biden likes to quote his father as saying, “Don’t tell me what you value, show me your budget, and I’ll tell you what you value.” Clearly, we have not been valuing our children.

Fortunately, in contrast to the divestments in our kids in the last four years, the American Recovery Plan Act’s commitment to cut child poverty in half is potentially life-changing for millions of our nation’s children. I say potentially because the provisions in the bill are temporary. Therefore, it is critically important for Congress to take the next step and, among a long list of policy improvements, make the CTC expansion and child care investments permanent.

Sixth, the American Rescue Plan Act was designed to, as Chabeli Carrazana and Errin Haines write, “to address long-standing racial and gender disparities laid bare by the pandemic” and economic recession. In addition to reducing racial disparities with respect to child poverty, the American Rescue Plan Act also addresses race and gender equity issues with regard to education, child care, child hunger, health care (including maternal mortality), vaccine distribution, child and family homelessness, expanded broadband access to children and families, and child abuse prevention.

The legislation underscores a long-term problem facing our nation’s children with respect to race equity and how federal support and engagement is critically important in helping reduce racial disparities that arise across states because southwestern (disproportionately Hispanic and Native American children) and southeastern (disproportionately Black children) states are poorer, provide less fiscal support and effort to kids’ programs, and have worse outcomes for children than the rest of the country.

And last, it is the right thing to do. Conor P. Williams writes:

The point is that children are both vulnerable and blameless. They are born into a world they did not choose. Each child’s life is ultimately her own project to develop and complete, but it is many years before she gets to take control. She deserves a childhood free from want, a childhood in which she is cared for, safe and well fed. A country as rich as ours can choose to reduce child poverty because doing so will improve children’s academic achievement and allow us to reduce our spending on remedial education, health care and more.

Or we can reduce child poverty simply because she deserves a real chance to grow into a healthy adult life full of opportunities to thrive. We can do it because there is no actual virtue in allowing millions of children to suffer simply to flatter our national disinclination to pay for a humane, modern, developed, democratic society. Or, put simply, we must do it because it’s the right thing to do.

Children are not just human “becomings” who deserve support because of the potential long-term return on investment or ROI. Children are deserving because they are human beings with fundamental needs in the here and now.