The U.S. Census Bureau released annual data on child poverty in the United States on September 10 that shows benefit programs are particularly effective at reducing poverty for children.

The U.S. Census Bureau calculates the Supplemental Poverty Measure (SPM) as an alternate measure to the Official Poverty Measure. Unlike the Official Poverty Measure, which uses an income threshold solely based on the cost of food, the SPM incorporates the cost of food, clothing, shelter and utilities. It also adjusts for family size and geographic differences in housing costs. The SPM further considers cash income (including child support) and non-cash benefits, subtracts taxes (or adds tax credits), work expenses, out-of-pocket medical expenses, and child support paid to another household.

When taking all of these factors into account, the SPM rate for children in 2018 was 13.7 percent, compared to 16.2 percent when using the Official Poverty Measure. The nearly two-point drop in poverty illustrates that benefit programs are particularly effective for children and must not only be protected, but strengthened so they can reach many more children still living in poverty.

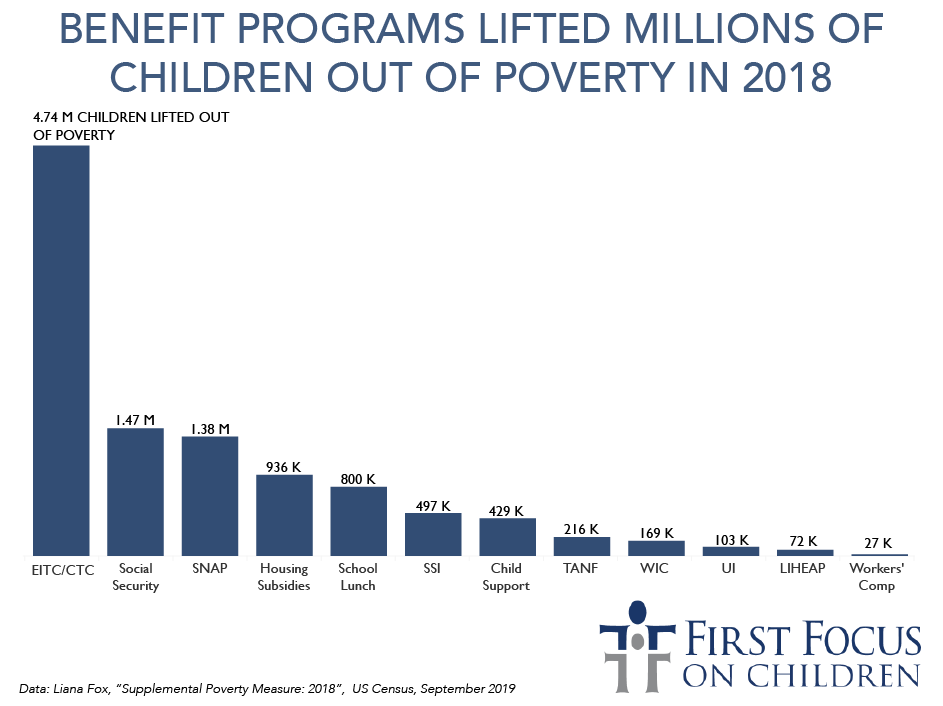

This year’s data shows that tax credits continue to be the strongest anti-poverty tool we have. Together, the Earned Income Tax Credit and the Child Tax Credit lifted 4.7 million children out of poverty in 2018.

The Supplemental Nutrition Assistance Program (SNAP) continued to be another powerful anti-poverty program for children in 2018. SNAP provides low-income households with monthly funds intended for grocery purchases, and while benefits under the program are modest (corresponding to roughly $1.40 per person per meal), they play a critical role in freeing up household resources and helping struggling families place food on the table. Given that more than 18 million children participate in SNAP—representing 44 percent of its beneficiaries—it is unsurprising that it kept almost 1.4 million children from falling into poverty last year. This data further underscores the importance of protecting children from proposed cuts to SNAP.

How Do These Programs Lift Children Out of Poverty?

A recent landmark study from the National Academy of Sciences, A Roadmap to Reducing Child Poverty, confirms that the negative outcomes associated with child poverty directly result from a lack of income.

Studies show that when parents and guardians receive cash assistance, they use it to provide resources for their children such as nutritious food, stable housing and educational supports that improve children’s healthy development. Increased income also relieves parental stress, giving them increased time and mental energy for their children.

More resources in a household in the short-term also improves children’s outcomes for the long-term. Studies show that children in households that received an increase in income through programs such as EITC or SNAP were healthier and earned more as adults, thereby helping to break the cycle of generational poverty.

A Roadmap to Reducing Child Poverty puts forward a set of policy and program options that, if implemented together, could cut our national child poverty rate in half within a decade. Within these options, they find that establishing a $3,000 annual child allowance would have the biggest impact of any single policy in reducing child poverty, and by itself could cut deep child poverty (children in households with incomes below half of the poverty line) in half within a decade. It would also address racial and ethnic disparities by having the biggest impact in reducing poverty for Black and Hispanic children.

The bottom line is that money matters to reducing child poverty. We could do more to reduce child poverty by:

- Establishing a national child poverty target. Child poverty is a solvable problem if there is the political will to take action. Establishing a national child poverty target – similar to ones in the United Kingdom, Canada and New Zealand as well as here in the United States – would be the first step toward holding lawmakers accountable to making child poverty a priority and implementing solutions. Bicameral legislation introduced in past sessions of Congress established a target and we hope to see this legislation reintroduced soon.

- Strengthening family tax credits. Currently 26 million children are unable to benefit from the full Child Tax Credit, and the 2017 tax law also widened income and racial disparities and neglected to expand the EITC and the Child and Dependent Care Tax Credit (CDCTC). Congress should alter that course and ensure that any legislation to extend tax breaks for businesses also include improvements for low-wage families with children.

- Creating a national child allowance – The American Family Act (S.690/H.R. 1560), the Working Families Tax Relief Act (S.1138/H.R. 3157), and the Economic Mobility Act (H.R, 3300) would establish child allowance programs. If signed into law, these proposals would implement one of the most effective policy changes to reduce child poverty identified in the NASEM study and currently adopted by numerous industrialized nations, such as Canada, Australia and nearly every European country — already proving the success of cash-transfer programs to struggling families and children.

- Protecting and improving SNAP – A recent proposed rule from the Administration would limit access to SNAP for millions of children, thereby weakening its effectiveness in reducing child food insecurity and child poverty. This is at the same time that new data from the USDA tells us that 11.2 million children (nearly 1 in 7) continue to experience food insecurity in the United States. Instead, we should invest in SNAP by increasing benefits for families with children.

For more recommendations on how to reduce child poverty in America, see First Focus Campaign for Children’s Proactive Kids Agenda for the 116th Congress and Children’s Budget 2019. For more information on the newly released Census data, see: Alarming 2018 Census Data Spurs New Call for National Poverty Targets.