Next week, millions of families will receive the last child tax credit payment of 2021. That we know for certain. But much else when it comes to the child tax credit (CTC) has been left extremely uncertain thanks to Congressional inaction — namely in the Senate. And, as we approach the holidays, and new complications from the Omicron variant, uncertainty is the last thing that families need.

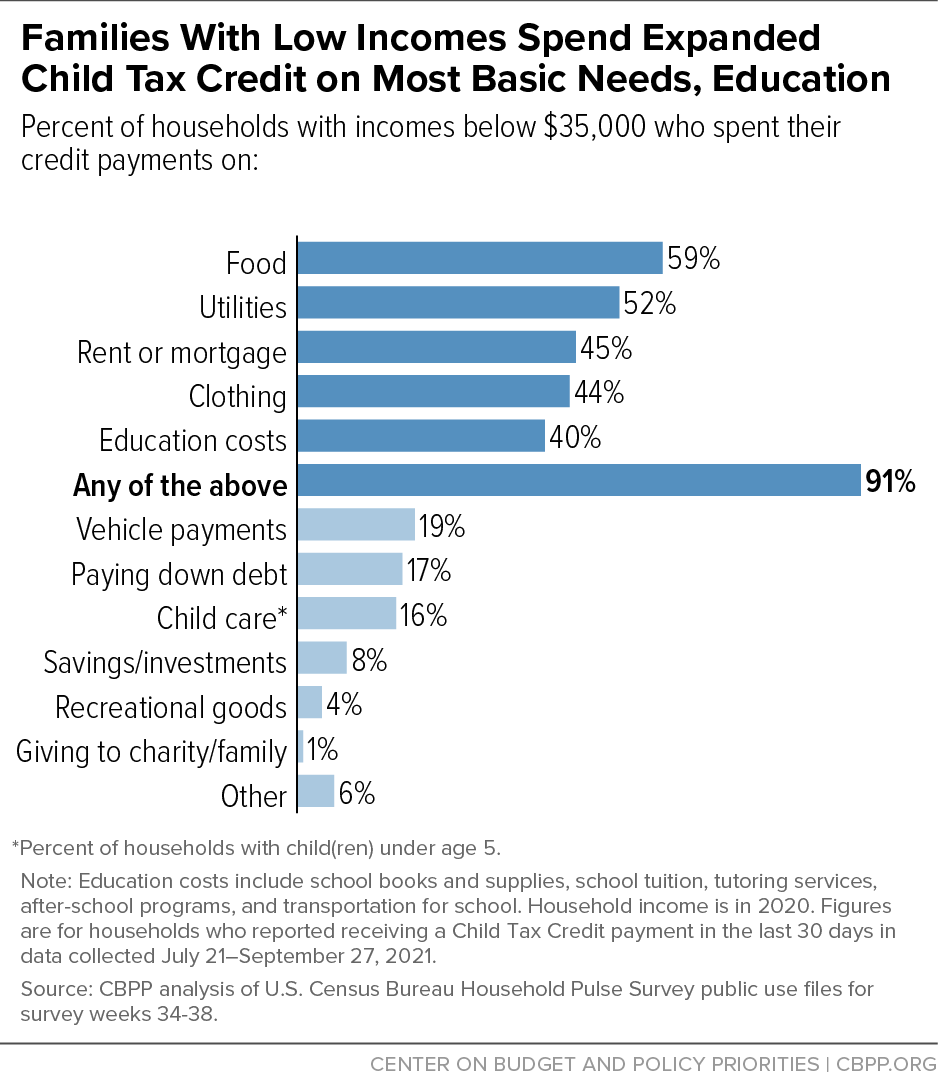

Here’s what we do know. The expanded child tax credit could lift 4.3 million children out of poverty. In fact, we know that these advance payments already have led to a 25% decrease in food insecurity. And we know that families have used these advanced payments to improve the lives of their children, spending their money — according to U.S. Census Bureau surveys — overwhelmingly to put food on the table or pay for essential school supplies and many even put some of it away to save for their kids’ future.

To put it simply, we know that the expanded CTC works.

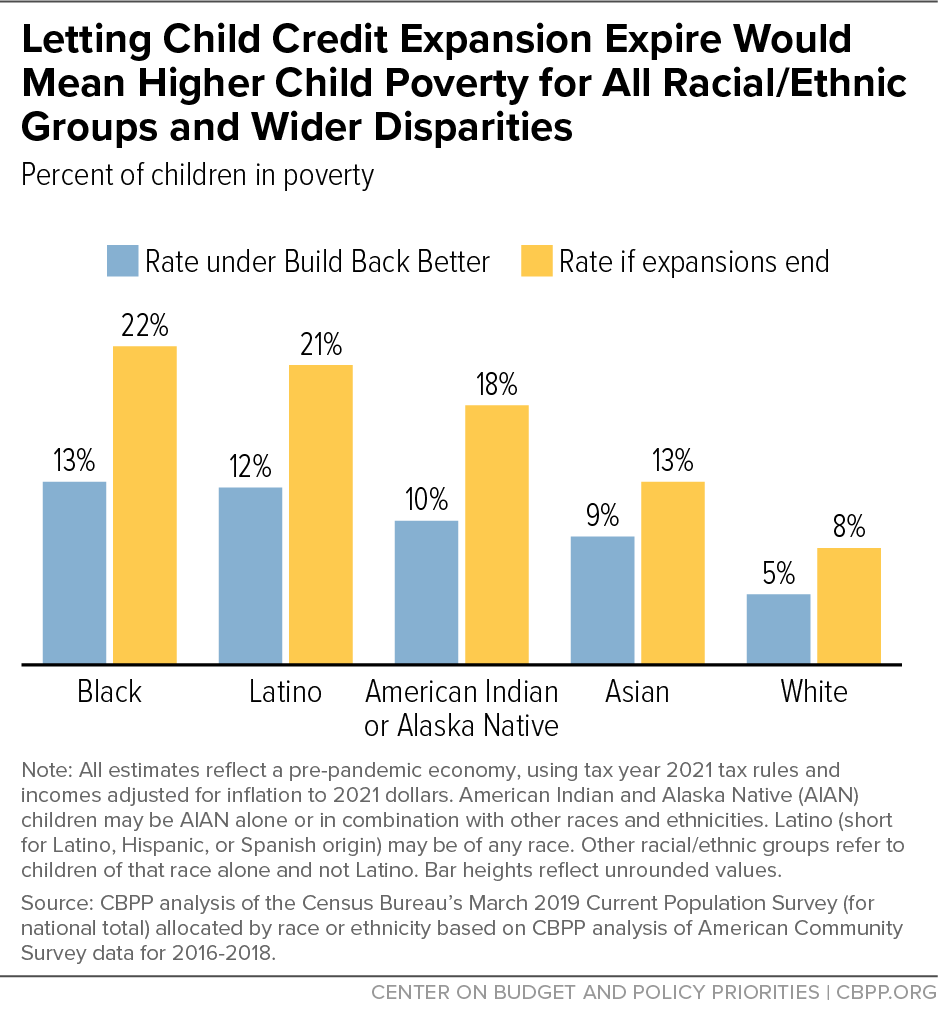

What is not certain, is whether Congress will see this overwhelming evidence and sign on for more progress. Champions for Children in the House fought successfully to extend the CTC through 2022, but House Republicans voted unanimously against it and Senate Republicans appear primed to do the same. The biggest uncertainty, however, may be whether or not wavering senators like Joe Manchin (D-WV) vote to invest in kids for at least one more year or follow their House Republican colleagues knowing that this move could cause child poverty to double almost as soon as they vote no.

So, as we approach the final CTC payment of 2021, here is what is at stake:

- By the end of this year, families should have received six advance payments, totaling up to $1,800 per child

- If families haven’t received the full child tax credit benefit through these monthly payments in 2020, the remainder of their money can come with a tax refund in 2022, assuming a return is filed between January and April of 2022

- Even if a family is not required to file taxes, they can — under the expanded child tax credit — still receive these monthly payments using the IRS’s non-filer tool

- More than 65 million children are currently eligible for the expanded, monthly CTC payments, but an estimated 39 million households would lose this benefit if Congress fails to act

- If Congress fails to act, 0 families will receive their monthly child tax credit payment on January 15

- If Congress fails to act, the child tax credit will no longer be “fully refundable” — meaning the full credit will no longer be available to families with low or no earnings in a given year (prior to the expansion of the CTC, 27 million children — including roughly half of Black and Hispanic kids and half of children in rural communities — fell into this category.

- If Congress fails to act, some families still eligible for the CTC will see their credits slashed by 44% (from $3,600 per to $2,000 per child)

- If Congress fails to act, parents of 17-year-old children will no longer be eligible to receive the CTC

- If Congress is to pass the Build Back Better Act, they must do by Dec. 28 to ensure January 2022’ss payments go out on time, according to reporting by the Huffington Post.

One last thing that we know for certain, is that Congress will only act when they hear from their constituents. So if you haven’t already, please reach out to your senator right now and let them know that an investment in our kids is an investment in our future and we can’t cut kids out when they need it most!