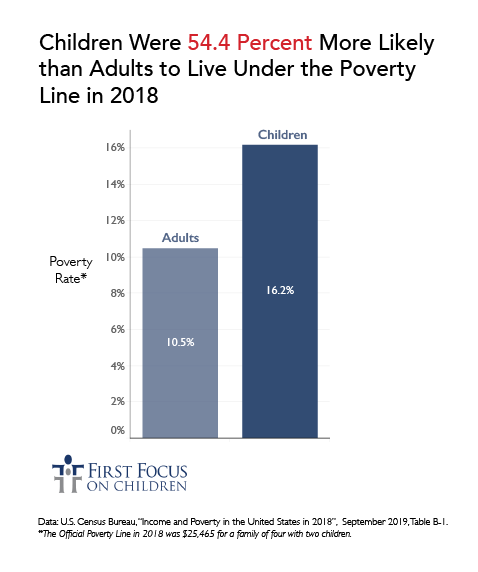

No child should live in poverty in a country with the wealth of ours. Yet, there were 12 million children in the United States living in poverty in 2019. Children were more than 50 percent more likely to live in poverty than adults. In a great nation, there is simply no excuse for this.

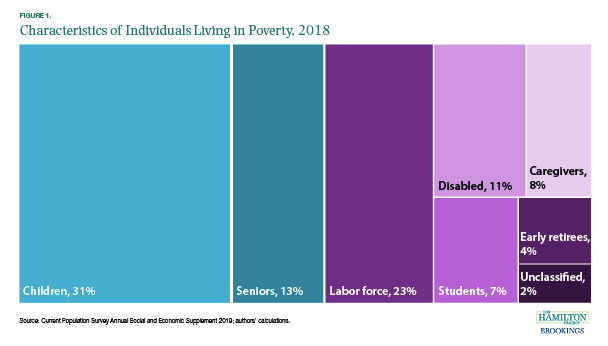

The following chart from the Hamilton Project at the Brookings Institution further highlights the disproportionate impact of poverty upon children.

Even before the pandemic and recession, the kids were not alright. In an international comparison, our nation is well behind other wealthy nations in a report by UNICEF on dozens of child well-being measures, including child poverty and child mortality. In that report, the United States ranks just 36th out of 38 countries — behind counties like Romania, Estonia, Slovakia, Latvia, Greece, Poland, Lithuania, and Malta.

Unfortunately, it all got worse for children in 2020, as kids and their families confronted a global pandemic, a worldwide economic recession, and high-profile cases of racial injustice. Every facet of the lives of children were and continue to be negatively impacted. The issues of poverty, hunger, and homelessness are striking families who never imagined that they could find themselves telling their kids that they don’t have any food or that the electricity has been shut off.

Fortunately, we may see significant relief and much needed immediate support for children and families if the Biden-Harris “American Rescue Plan” is enacted into law in the next few weeks.

The package would provide for:

- An additional $1,400 in checks to both adults and children on top of the $600 passed in December — a significant improvement on the original CARES Act passed in early 2020 that provided $1,200 to adults and just $500 to children.

- $400-a-week in extra unemployment insurance payments.

- $170 billion to public schools and higher education.

- $39 billion for child care.

- Important improvements to the Child and Dependent Care Tax Credit (CDCTC).

- Extension of credits for paid sick and family leave.

- $350 billion in relief to state and local governments.

These are all important for children.

However, what stands out is the Biden-Harris proposal to make the Child Tax Credit (CTC) fully refundable to help the 23 million children in this country — one-third of all of our kids — whose parents make too littleto qualify for the full child benefit, which is $2,000 annually under current law. The legislation also raises the amount of the CTC to $3,600 to families with children 5 and under ($300 per month) and $3,000 to families with children 6–17 years-of-age ($250 per month).

According to the Center on Poverty and Social Policy at Columbia University, it is estimated that the package would cut child poverty by more than half. If passed into law, this proposal would represent the most significant public policy change for children when it comes to addressing poverty in this country since the CTC was first enacted by Congress in 1997.

There are many members of Congress and their staff who deserve immense respect and thanks for their work over the years to push for this important improvement in the CTC. Among them:

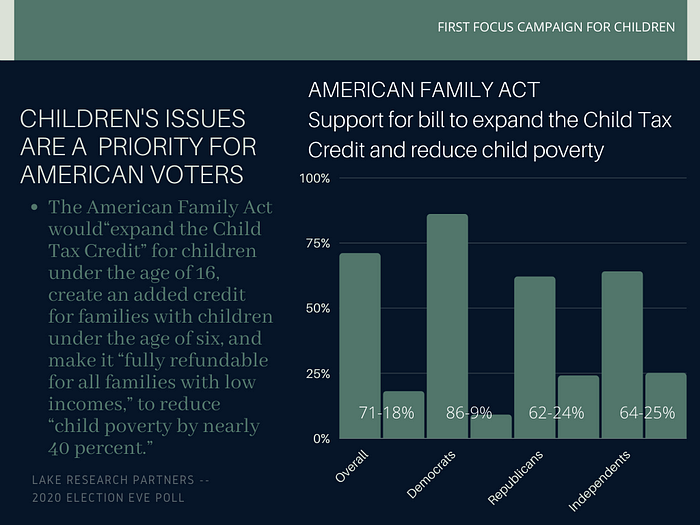

- Sens. Michael Bennet (D-CO), Sherrod Brown (D-OH), and Cory Booker (D-NJ) and Reps. Rosa DeLauro (D-CT) and Suzan DelBene (D-WA) for introducing and refining the “American Family Act” over the last few sessions of Congress and pushing hard to make it a top priority in Congress and the Biden-Harris Administration.

- Senate Finance Committee Chairman Ron Wyden (D-OR) and House Ways and Means Committee Chairman Richard Neal (D-MA) for making this a centerpiece of the Senate and House relief packages, respectively.

- Reps. Barbara Lee (D-CA) and Lucille Roybal-Allard (D-CA) for successfully offering the amendment to fund the 2019 National Academies of Sciences, Engineering and Medicine’s (NASEM) landmark report, A Roadmap to Reducing Child Poverty, which gathered the evidence-based research supporting the importance of cutting child poverty for our economy (costing as much as $1.1 trillion annually) by improving the life chances and potential success of our children. The study also offered bipartisan pathways for reducing child poverty by more than half that centered around improving the CTC.

- Sen. Bob Casey (D-PA) and Rep. Danny Davis (D-IL) for introducing the “Child Poverty Reduction Act,” which takes the lessons learned from the United Kingdom and Canada to create a national “child poverty target” that ensures that there is attention, focus, and accountability in government for cutting child poverty by more than half.

- Sens. Mitt Romney (R-UT), Marco Rubio (R-FL), Mike Lee (R-UT), and Tim Scott (R-SC) also deserve credit for offering proposals to significantly improve the CTC to cut child poverty, as Romney did last week, and Rubio, Lee, and Scott proposed back in 2017.

It is well past time that we recognize that children are not doing well and take action to improve their lives and well-being.

Four years ago, a report by the Child Poverty Action Group, led by First Focus on Children, the National Association for the Education of Young Children (NAETC), Save the Children Action Network (SCAN), MomsRising, and Prosperity Now (formerly for Corporation for Enterprise Development), called for improvements to the CTC and CDCTC to improve fairness in the tax code for our nation’s families, so that low-income families are no longer penalized for earning too little to qualify for the full CTC and CDCTC credits. These recommendations have been included in the Biden-Harris proposal and the draft congressional packages.

If enacted, this will be historic for our nation’s children. Poverty vanquishes the hopes and dreams of our children. It negatively impacts their health, education, nutrition, safety, shelter, and overall well-being. We must stop averting our eyes, ears, and hearts to the plight of children living in poverty.

In his book Promises to Keep: On Life and Politics, Sen. Joe Biden spoke of the promises to make and keep, including those to our children. He writes:

It’s time for a president to stand up and remind the American people that we have promises to keep — promises to the world, promises to one another, promises to our children and to our grandchildren. In rededicating ourselves to the hard work of fulfilling those promises, we restore America as the hope of the world and the vision of a brighter future.

He adds:

These are the promises we must make to our children. These are not someone else’s children — they are our children, America’s children. . . We have always counted on the next generation to carry forward the goals we fail to reach in our own time, and if we don’t protect the health and the dreams of all of our children, we are betraying our own best intentions.

Although the stimulus package is temporary, the Joint Committee on Taxation estimates that it would provide $110 billion in tax credit improvements to children and families this year. The Biden-Harris Administration and Congress should pass this now and come back later this year to make these changes permanent.

Our children are not alright. The American people understand that we cannot wait any longer. In an election eve poll of American voters by Lake Research, voters supported passage of the “American Family Act” by an overwhelming 71–18% margin.

Our children are hurting. Our children cannot wait. Congress must act now to protect the dreams of our kids this year and into the future.