When the Senate returns later this month, the question of the Child Tax Credit will be waiting. We offer here three key points that Senators on both sides of the aisle must understand about H.R. 7024, aka, The Tax Relief for American Families and Workers Act of 2024:

1. The Child Tax Credit has always enjoyed bipartisan support:

The bipartisan National Commission on Children was established and signed into law more than 35 years ago by President Ronald Reagan. The Commission’s final report, delivered to President George H.W. Bush in 1991, recommended creation of a fully refundable Child Tax Credit that would go to all families with children. In English: The Commission’s plan was to give the credit to every family with children and to deliver the full amount of this credit to all children, regardless of the circumstances of their caregivers.

Newt Gingrich and his Congress passed the very first Child Tax Credit, which President Bill Clinton signed into law in 1997. Incremental improvements were made to the credit under presidents George W. Bush (2001), Barack Obama (2009) and Donald Trump (2017).

In that tradition of bipartisanship, the House passed H.R. 7024 with an overwhelmingly bipartisan 357-70 vote. The Senate should do the same.

2. The “per child” adjustment is key to making the credit most effective:

The House-passed bipartisan Child Tax Credit would increase the maximum refundable tax credit per child to $1,800 for 2023, $1,900 for 2024, and $2,000 for 2025, with inflation adjustments starting after 2023. And — in a step toward fairness — would extend this benefit to low-income children previously excluded.

Under current law, wealthier families receive the full credit every time they have a new baby. Low-income families do not.

Sadly, some lawmakers have hijacked H.R. 7024’s per-child refundability issue , suggesting that giving low-income families the full credit is merely a handout. In fact, as the bipartisan Commission noted, full, per-child refundability offers a “bridge” to the economic mainstream:

“Because it would assist all families with children, the refundable child tax credit would not be a relief payment, nor would it categorize children according to their “welfare” or “nonwelfare” status. In addition, because it would not be lost when parents enter the work force, as welfare benefits are, the refundable child tax credit could provide a bridge for families striving to enter the economic mainstream.”

3. The “lookback” serves everybody’s interests:

Critics also oppose H.R. 7024’s “lookback” provision, which would allow families to claim the credit based on a prior year’s earnings if they experience an income decline in the current taxable year.

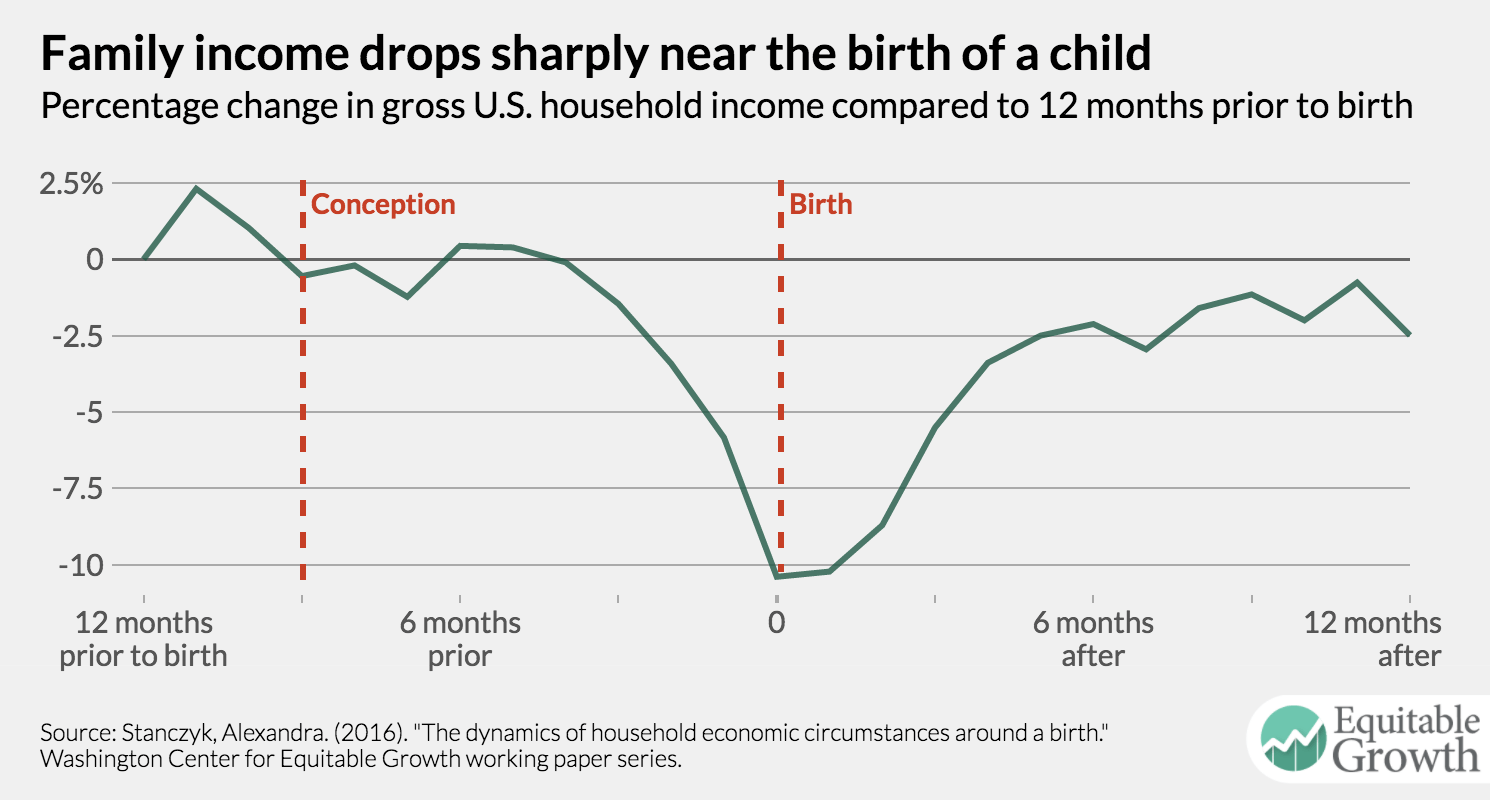

In fact, the “lookback” acknowledges the very real financial burdens of pregnancy, childbirth and raising a baby. Research shows that women experience a dramatic loss of income during pregnancy, through the birth of a child, and for months or even years afterward. The lookback also offers a respite to children whose families lose income because of a natural disaster, layoffs, factory closings, and other unpredictable assaults on income.

The “lookback” provision in H.R. 7024 will also help reduce (but not eliminate) child poverty and disparities inherent in the current Child Tax Credit.

As First Focus on Children President Bruce Lesley told National Journal this week, critics’ objections do not align with their stated goals to support children and families. The “lookback” and “per child” phase-in policies work together so that families aren’t penalized for having another child.

“The kids punished under the current child tax credit are babies,” he said. “If you have a new baby, you get nothing. In fact, you lose money because your income goes down.”