On September 13, 2022, the U.S. Census Bureau reported that the United States saw the lowest child poverty rate on record, with 5.2% of children (3.8 million) living below the poverty line in 2021. The United States also saw the lowest one-year drop in child poverty on record, a 46% decline since 2020. For the first time, children experienced lower poverty rates than adults.

This new data confirms that child poverty is a policy choice — we know how to address it, we just need the political will to act.

This historic decline in child poverty in 2021 is due to significant, but temporary, investments made for children in the American Rescue Plan Act. Improvements to the Child Tax Credit generated much of this impact, on their own preventing nearly 3 million children from experiencing poverty in 2021. The third round of Economic Impact Payments, continued expansions to the Unemployment Insurance program, and continued increases to benefits under the Supplemental Nutrition Assistance Program (SNAP) also had a significant impact on child poverty.

While this progress is unprecedented and worth celebrating, it also greatly underestimates hardship and still leaves many children behind. Income thresholds used to measure poverty remain much too low, so many households with children with incomes at double the poverty line still experience significant financial insecurity and struggle to make ends meet.

Children of color experienced poverty at record lows in 2021, but significant racial and ethnic disparities still exist. Children in immigrant families still face more significant barriers to economic stability than non-immigrant families due to restricted access to tax credits and other benefits. The data does not consider children in Puerto Rico and the other U.S. territories but figures show they face higher rates of poverty than children in the 50 states and the District of Columbia due to their unequal access to federal benefits as part of a long history of racism and discrimination against Americans living in the territories.

But unless Congress acts quickly to extend improvements to the Child Tax Credit, the progress achieved in 2021 will only be temporary. We have already seen backtracking on this progress in 2022, with nearly 4 million children pushed back into poverty in January. The loss of the improvements to the Child Tax Credit combined with high food costs and rising rents means that many families are once again experiencing significant material hardship.

Annual Census Data for 2021

Supplemental Poverty Measure

The SPM is the most realistic measure of annual poverty, using a household income threshold based on the cost of food, clothing, shelter, utilities, and a small number of other needs, and adjusts this figure for family size and geographic differences in housing costs. The census then considers cash income (including child support), in-kind benefits, minus taxes (or plus tax credits) work expenses, out-of-pocket medical expenses, and child support paid to another household.

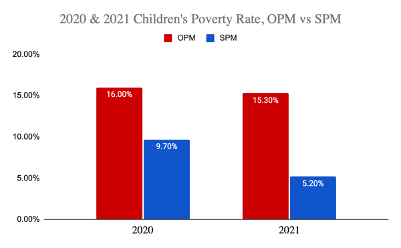

Using the SPM, which considers the impact of the Child Tax Credit and other critical assistance provided for households with children in 2021, 5.2% of children (3.8 million) lived in poverty compared to 9.7% (7 million) in 2020, a 46% decrease.

- Children of color experienced historic decreases in poverty in 2021 but still experienced poverty at a significantly higher rate than white children:

- Black children (alone, non-Hispanic): 8.3%

- Hispanic children (any race): 8.4%

- White (alone, non-Hispanic): 2.7%

- American Indian and Alaska Native: 7.4%

- Asian (alone): 5.1%

- Black children (alone, non-Hispanic): 8.3%

- Nearly 1.4% of children (over 1 million) were still living in deep poverty. These are children in households with very few resources ($15,000 a year or less for a family of four with two children) who face severe deprivation.

- 31.4% of children (over 20 million) were living in households with annual incomes above the poverty threshold — up to double the threshold, or roughly $60,000 a year for a family of four with two children — but were still struggling with material hardship.

- Using the Economic Policy Institute’s Family Budget Calculator, a family of four with two children needs at least an annual income of $80,000 a year in most areas to have an adequate, but modest, standard of living.

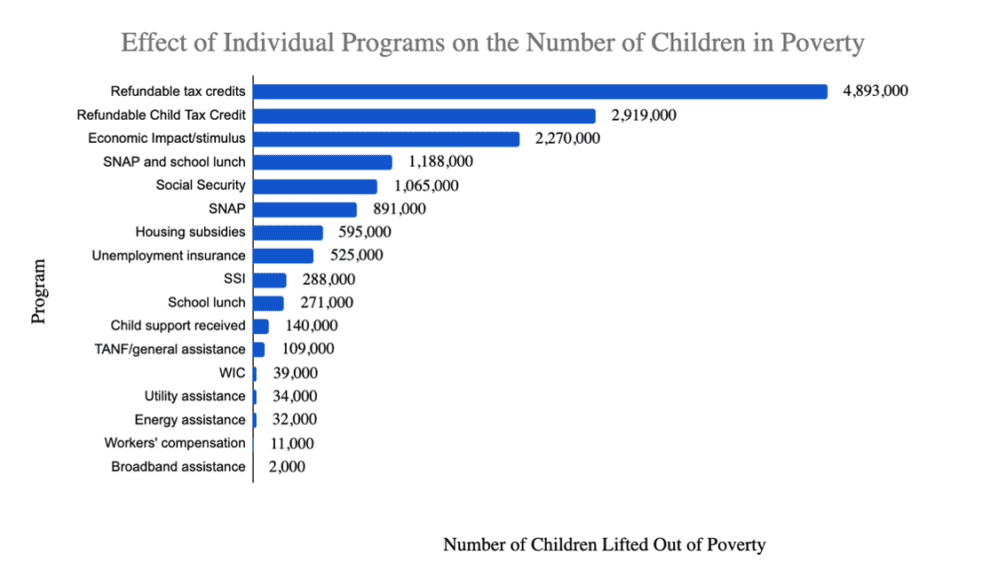

Below are government programs included in the SPM and the number of children lifted out of poverty because of each program.*

*Note that these numbers reflect program increases and benefit enhancements made in the American Rescue Plan Act (H.R. 1319), which include the continuation of increases and enhancements from past aid packages. Refundable tax credits include the Earned Income Tax Credit, Child Tax Credit, and the Child and Dependent Care Tax Credit.

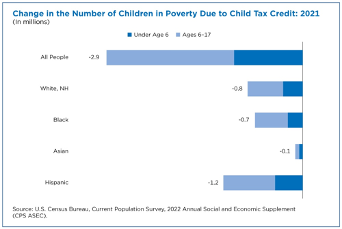

The Child Tax Credit alone lifted nearly 3 million children out of poverty in 2021, including 1 million children under the age of 6. Child poverty would be nearly double in 2021 without the impact of temporary improvements made to the Child Tax Credit in 2021 that greatly increased the amount of the credit, made payments available monthly for half of the year, and allowed families with little or no income to be eligible for the full credit for the first time. The Child Tax Credit also helped to narrow the poverty gap for Black and Hispanic children compared with white children.

Some immigrant families with children face higher barriers to accessing the Child Tax Credit and other assistance, and others may avoid filing for tax credits or other benefits out of fear of negative implications for their immigrant status. Discriminatory eligibility rules restrict access to programs — for example, an estimated 1 million immigrant children without Social Security numbers have been unfairly excluded from receiving the Child Tax Credit since 2018.

Children in Puerto Rico and the other U.S. territories are not accounted for the in the Supplemental Poverty Measure, but available data shows that they continue to experience poverty rates three times higher than children in the 50 states. Improvements to the Child Tax Credit made in the American Rescue Plan Act included a permanent expansion to allow families of all sizes in Puerto Rico to be eligible. (Previously, only families with three or more children were eligible, leaving out 90 percent of families on the island.) Families in Puerto Rico, however, were not eligible to receive the advanced monthly payments, and efforts are still ongoing to help eligible families in Puerto Rico file for the credit.

Official Poverty Measure

The Official Poverty Measure represents the share of children in the United States under age 18 who live in families with incomes below the federal poverty level, which is used to determine eligibility for many public assistance and means-tested federal programs. The OPM only accounts for pre-tax cash income and uses a federal poverty definition that consists of a series of thresholds based on family size and composition. In 2021, poverty was defined as annual income below $27,479 for a family of four with two children, while extreme poverty was defined as less than $13,739 per year.

The OPM shows that without the impact of tax credits and in-kind benefits, child poverty is significantly higher, at three times the rate at 15.3% compared to 5.2% under the SPM. Using the OPM, about 11.1 million children experienced poverty in the U.S. in 2021, compared to 11.8 million last year.

USDA Food Insecurity Data

The USDA recently published data on food insecurity in the United States in 2021 and reported a decrease from 2020 in food insecurity for households with children. 6.2% of households with children faced food insecurity in 2021, down from 7.6% in 2020. These are households that were unable at times to provide adequate, nutritious food for their children. The rate of households with children with very low food insecurity remained statistically unchanged from 2020, meaning 274,000 households had children that went hungry, skipped a meal, or did not eat for a whole day because of lack of money for food. In some food insecure households, only adults were food insecure, as often caregivers can shield young children from the impacts of food insecurity. However, almost 5 million children lived in households where at least one child was food insecure.

Despite the pandemic, investments in nutrition programs such as USDA waivers allowed millions of children to eat lunch at school at no cost and the creation of the Pandemic EBT program helped to mitigate child hunger when school is out. Yet child hunger in the U.S. remains stubbornly high.

Other helpful data resources

The Annie E Casey Foundation’s Kids Count Data Center

U.S. Census Bureau’s Household Pulse Survey

Columbia’s Center on Poverty and Social Policy Monthly Poverty Data